Canada’s real estate market has experienced significant growth in recent years, leading to concerns about the possibility of a real estate bubble. A real estate bubble occurs when the price of real estate becomes artificially inflated, often due to speculation or the belief that prices will continue to rise. When a bubble bursts, it can lead to a significant decrease in property values, causing financial hardship for homeowners and investors.

Historically, Canada has seen real estate bubbles in certain regions or markets, most notably in the late 1980s and early 1990s, when the country experienced a recession. During this time, the housing market in Canada saw significant declines in prices and a surge in foreclosures.

More recently, there have been concerns about the possibility of a real estate bubble in Canada due to the rapid increase in housing prices in certain markets, particularly in the cities of Toronto and Vancouver. These two cities have consistently ranked among the most expensive real estate markets in the country, with the average price of a detached home in Vancouver reaching over $1.5 million in 2021.

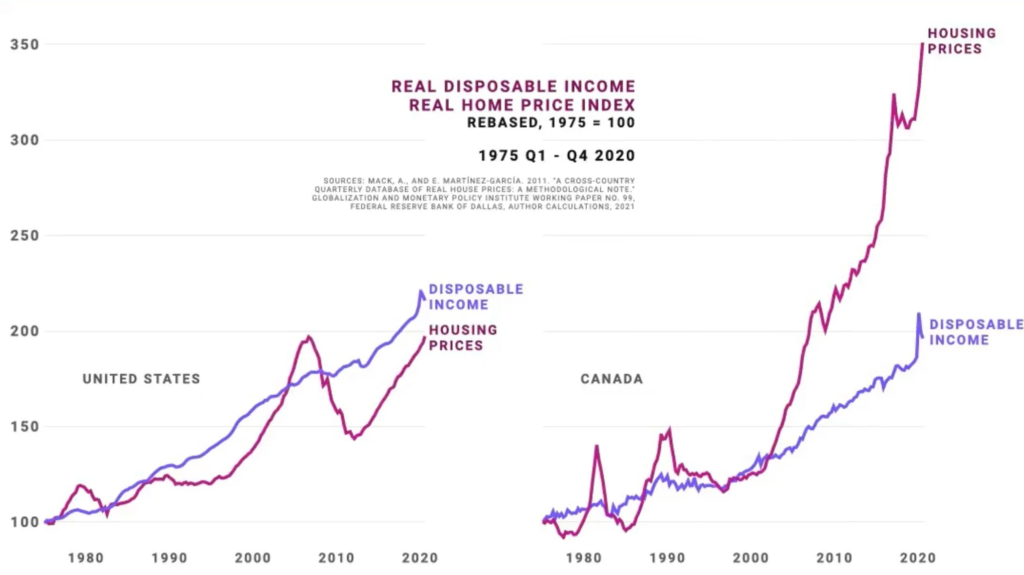

There are several indicators that can suggest the possibility of a real estate bubble in a given market. One such indicator is the price-to-income ratio, which compares the median house price to the median income of the area. A high price-to-income ratio can indicate that the cost of housing is out of reach for many potential buyers, potentially leading to a bubble. In Canada, the price-to-income ratio in some markets, such as Toronto and Vancouver, has been consistently above the national average, raising concerns about the sustainability of housing prices in these markets.

Another indicator of a potential real estate bubble is the presence of speculators in the market. When speculators, or individuals who buy properties with the intention of flipping them for a profit, become a significant presence in the market, it can drive up prices and create unsustainable demand. In Canada, there have been concerns about foreign buyers and speculators driving up housing prices in certain markets, particularly in Toronto and Vancouver.

“Inflation has come down in recent months, but we have yet to see a generalized decline in price pressures,” Macklem said. “This tightening phase will draw to a close. We are getting closer, but we are not there yet.”

A third indicator of a potential real estate bubble is the overvaluation of properties. This can occur when the value of a property is significantly higher than the value of similar properties in the same market, indicating that the price may not be supported by fundamentals such as demand and economic conditions. In Canada, there have been concerns about the overvaluation of certain types of properties, such as condominiums, in certain markets.

There are also several macroeconomic factors that can contribute to a real estate bubble. These include low interest rates, which can make borrowing to buy a home more affordable, and high levels of consumer confidence, which can drive up demand for housing. In recent years, both of these factors have been present in Canada, with the Bank of Canada maintaining low interest rates to support economic recovery and consumer confidence remaining relatively high.

It is important for potential buyers and investors to be aware of the risks associated with a real estate bubble and to do their due diligence before making a purchase. This includes carefully considering the price-to-income ratio, the presence of speculators, and the potential for overvaluation in the market. It is also important to consider the long-term economic conditions and the potential for future interest rate changes, as these can have an impact on the sustainability of housing prices.

One factor that has contributed to concerns about a real estate bubble in Canada is the rapid rise in homeowners who are on variable rate mortgages. A variable rate mortgage is a type of home loan with an interest rate that can fluctuate over time, typically based on changes in a benchmark interest rate.

In recent years, many Canadians have taken out variable rate mortgages due to low interest rates, which can make borrowing more affordable. However, this can also present risks, as rising interest rates can lead to higher monthly mortgage payments, potentially putting financial strain on homeowners.

In Canada, there is a trigger point for variable rate mortgages, which is the point at which the interest rate on the mortgage exceeds a certain percentage. If this trigger point is reached, homeowners may be required to pay additional funds, known as a “stress test,” to ensure that they can afford their mortgage payments if interest rates were to rise.

The rapid rise in homeowners on variable rate mortgages who are approaching the trigger point has raised concerns about the potential impact on the housing market if interest rates were to increase. If a significant number of homeowners were unable to afford their mortgage payments due to higher interest rates, it could lead to a decrease in demand for housing and potentially a drop in housing prices.

It is important for homeowners on variable rate mortgages to be aware of the risks associated with this type of loan and to carefully consider their financial situation before taking on a mortgage. This includes considering the potential impact of rising interest rates on their monthly payments and ensuring that they can afford their mortgage payments even if rates were to increase.

In conclusion, while the Canadian real estate market has experienced significant growth in recent years, there are concerns about the possibility of a real estate bubble, particularly in certain markets such as Toronto and Vancouver. Potential indicators of a bubble include a high price-to-income ratio, the presence of speculators in the market, and the overvaluation of properties. The rapid rise in homeowners on variable rate mortgages who are approaching the trigger point is also a factor that has contributed to concerns about the sustainability of housing prices. It is important for potential buyers and investors to be aware of these risks and to do their due diligence before making a purchase in order to protect their financial interests.