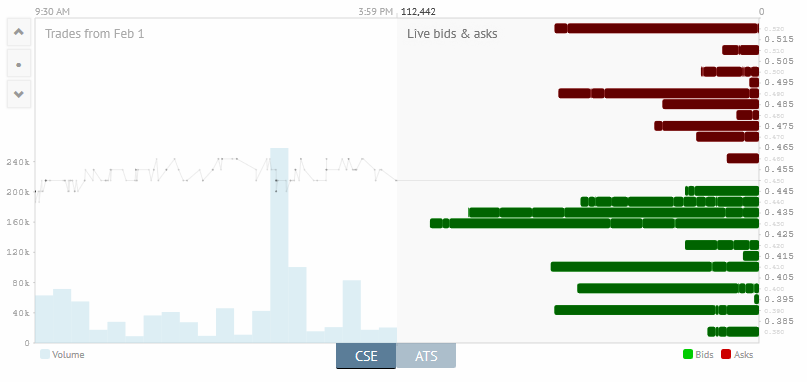

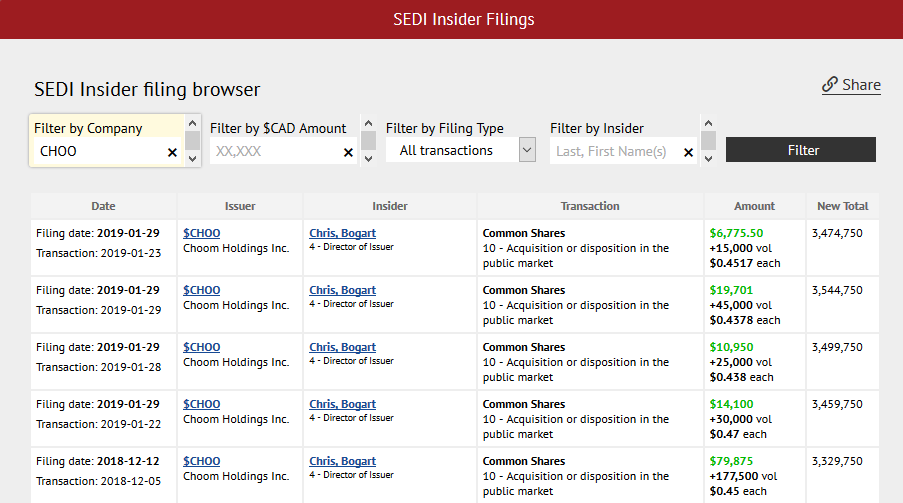

Taking a look at Choom Holdings on the weekly chart we are seeing a technical “W” bottom formation taking place in the mid 0.40’s. MACD starting to curl up and make a cross with the trade line and the MFI pushing out of oversold territor. Starting to see increasing volume and a solid bid support building on L2. We are giving CHOO.c a speculative buy with a stop out price of 0.39. One more notable indicator is the recent insider buying from the CEO Chris Bogart, within the last 3 months he’s purchased 292,500 shares in the open market which we perceive as a bullish indicator.

Symbol: CHOO.c

Market Outlook: We are expecting Choom Holdings to finish forming its double bottom on this new support base its created in the mid 0.40’s then make a technical bounce above the 100sma on the weekly chart.

Support: $0.42-0.45

- Support Base: $0.42-0.45

- Lower BB: $0.41

Resistance: $0.48 (Daily Chart)

- Upper BB – $0.52

- 50sma – $0.48

Technicals: MACD starting to curl and make its cross above the trade line and the money flow index pushing out of the over sold range on the weekly chart. Starting to see increased volume and solid bid support on L2 in the 0.42-0.45 range

Stop Out: $0.39

Sentiment: Bullish