Market Depth

- Bid Price – The price traders are willing to purchase a stock at a specified buy price.

- Bid Size – The quantity of shares (or lots) that traders are willing to buy at that ask price.

- Ask Price – The price traders are willing to sell a stock at a specified buy price.

- Ask Size – The quantity of shares (or lots) that traders are willing to sell at that ask price.

- Last Price – The price at which the last transaction had occurred.

- Last Size – The quantity of shares that were exchanged in the last transaction.

- Broker – The dealer that undertakes the duty to complete a specified transaction.

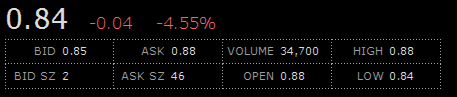

Level 1 – This is a very straight forward one dimensional view of the bids and asks, as you can see you are only able to view the highest bid and lowest ask and not the “depth” of the market for that particular stock. You can see the highest bid price at 0.85 – The lowest ask price which is at 0.88 and the size of order at that specific price, the difference between the bid and ask (0.88-0.85= 0.03) is called the spread.

Level 2 – This gives you the full depth of buys and asks in any particular stock, by utilizing L2 you are able to determine the short term strength and/or weakness of a stock by the size of the orders on either the bid or ask. Its good to get familiar with the different broker ID numbers as they tend to have different rolls in how a stock trades. For instance Broker or “house” 001 is mainly used for institutional transactions meaning there could be non open market shares hitting the market in terms of ice berg orders.

Provided Information:

- Broker ID (house/ Market Maker)

- Bid/Ask Date

- Size

- Price

Different Level 2 designs

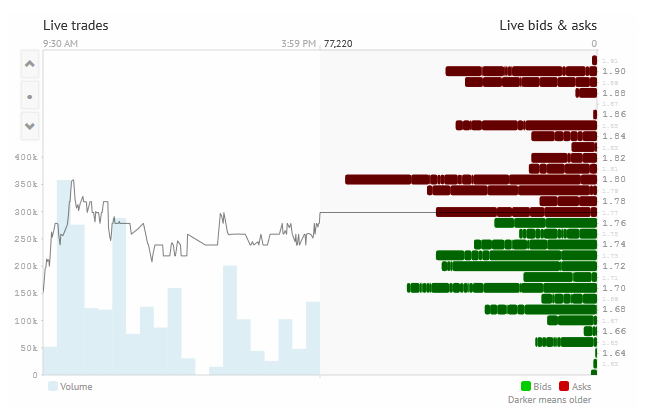

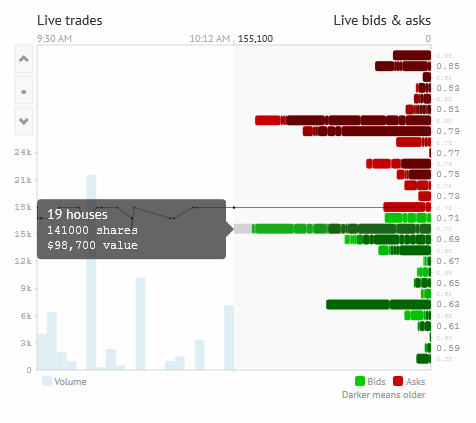

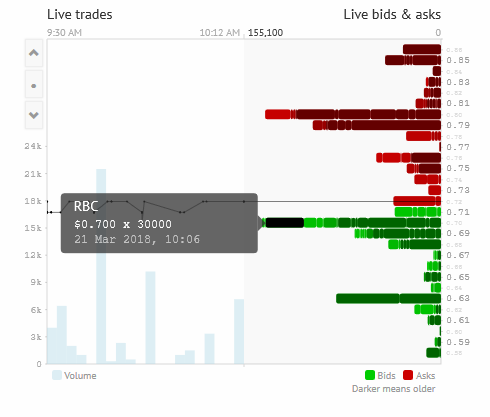

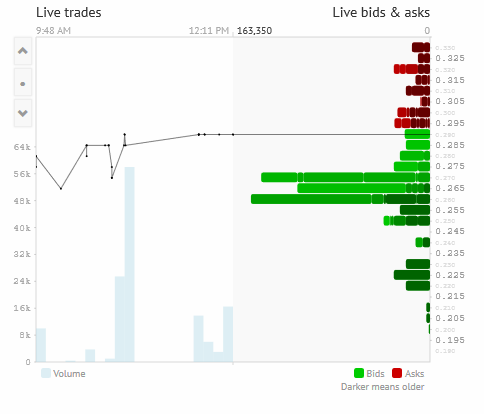

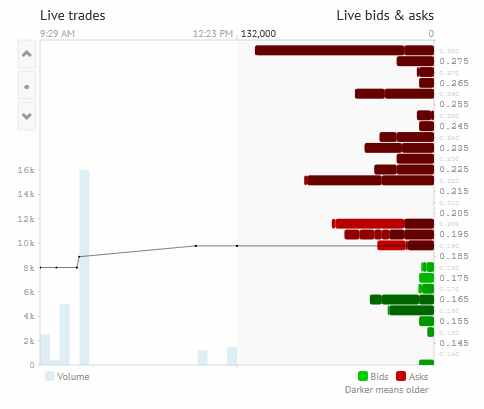

Visually this is one of my favorite level 2 designs, it shows the size of orders through the visual size of bars, and gives you a total share count for each price level as well as a dollar value. They signify the older orders with a darker shade and the newer orders with a lighter colour, and gives you a total number of houses at that price. This is a very quick and easy way to decipher the strength and weakness of the market depth.

You can see that RBC has a 30,000 bid at 0.70 that was put up on March, 21st 2018 at 10:06am, now because its highlighted it looks darker but it is a new bid which is why it its lighter green (see photo above) There are many different ways a market makers can fill your orders, predominately Limit Orders are filled through Electronic Communications Network (ECN) which automatically match buy and sell orders. These systems are used specifically for limit orders because the ECN can match by price very quickly.

This is an example of a “strong” (or stacked) level 2 would look like in the case of the bulls going long. You will notice larger bids present and you will see buying on the ask if the momentum is strong enough.

Here is an example of what a “weaker” level 2 would look like in the case of the bears going short or general downward pressure on the stock. You will notice larger asks present and selling on the bid which is called panic selling.

Level 3 – This is only used on the institutional level of trading, level 3 quotes grant an investor the ability to enter or change quotes, execute orders, and send out confirmations of trades. Retail traders do not have access to level 3. Check out Market Depth – Advanced

Market Participants

1. Market Makers (MM) – These are the players who give liquidity in the marketplace. This implies they are required to purchase when no one else is purchasing and offer when no one else is offering. They make the market. The Market Maker purchases and offers the stock to financier firms.

2. High Frequency Trading (HFT) – It is an electronic framework that uses computers to input a large number of buy and sell orders at very fast speeds. It uses complex algorithms to analyze multiple markets and execute orders based on market conditions.

3. Retail Traders – A retail trader/ investor is someone who buys and sells securities within their own personal account and not for a company or organization.

4. Institutional Traders – Are individuals that purchase securities within accounts for a group, fund or institution.

Broker ID

| TSX TRADING # | PARTICIPATION ORGANIZATIONS |

| 1

2 |

Anonymous

RBC Capital Markets |

| 3 | Altacorp Capital Inc. |

| 4 | Cantor Fitzgerald Canada Corporation |

| 5 | Citadel Securities Canada ULC |

| 7 | TD Securities Inc. |

| 8 | Eight Capital |

| 9 | BMO Nesbitt Burns Inc. |

| 11 | Macquarie Capital Markets Canada Ltd. |

| 12 | Electronic Transaction Clearing Canada Inc. |

| 13 | Instinet Canada Ltd. |

| 14 | ITG Canada Corp. |

| 15 | UBS Securities Canada Inc./UBS Valeurs Mobilieres Canada Inc. |

| 16 | Paradigm Capital Inc. |

| 17 | Integral Wealth Securities Limited |

| 18 | Echelon Wealth Partners Inc. |

| 19 | Desjardins Securities Inc. |

| 21 | Pavilion Global Markets Ltd. |

| 22 | Fidelity Clearing Canada ULC |

| 23 | State Street Global Markets Canada Inc. |

| 24 | Clarus Securities Inc. |

| 25 | Odlum Brown Ltd. |

| 27 | Dundee Securities Ltd. |

| 28 | BBS Securities Inc. |

| 31 | Dominick Inc. |

| 33 | Canaccord Genuity Corp. |

| 34 | Maison Placements Canada Inc. |

| 35 | Friedberg Mercantile Group |

| 36 | W.D. Latimer Co. Ltd. |

| 38 | Liquidnet Canada Inc. |

| 39 | Merrill Lynch Canada Inc. |

| 42 | Global Maxfin Capital Inc. |

| 43 | Caldwell Securities Ltd. |

| 47 | Timber Hill Canada Company |

| 48 | Laurentian Bank Securities Inc. |

| 53 | Morgan Stanley Canada Ltd. |

| 55 | Velocity Trade Capital Ltd. |

| 56 | Edward Jones |

| 57 | Interactive Brokers Canada Inc. |

| 58 | Qtrade Securities Inc. |

| 59 | PI Financial Corp. |

| 62 | Haywood Securities Inc. |

| 65 | Goldman Sachs Canada Inc. |

| 68 | Leede Jones Gable Inc. |

| 70 | Manulife Securities Incorporated |

| 72 | Credit Suisse Securities (Canada), Inc. |

| 73 | Cormark Securities Inc./Valeurs Mobilieres Cormark Inc. |

| 74 | GMP Securities Limited |

| 76 | Industrial Alliance Securities Inc. |

| 77 | Peters & Co. Ltd. |

| 79 | CIBC World Markets Inc. |

| 80 | National Bank Financial Inc. |

| 81 | HSBC Securities (Canada) Inc. |

| 83 | Mackie Research Capital Corp. |

| 84 | Independent Trading Group |

| 85 | Scotia Capital Inc. |

| 86 | Pictet Canada L.P. |

| 87 | Beacon Securities Ltd. |

| 88 | Credential Securities Inc. |

| 89 | Raymond James Ltd. |

| 90 | Barclays Capital Canada Inc. |

| 91 | JonesTrading Canada Inc. |

| 92 | Pollitt & Co. Inc. |

| 94 | Hampton Securities Ltd. |

| 97 | M Partners Inc. |

| 99 | JitneyTrade Inc. |

| 101 | Société Générale Capital Canada Inc. |

| 102 | Lakeshore Securities Inc. |

| 123 | Citigroup Global Markets Canada |

| 124 | Questrade Inc. |

| 132 | Acker Finley Inc. |

| 143 | Pershing Securities Canada Ltd. |

| 150 | Trapeze Capital Corp. |

| 200 | Acumen Capital Finance Partners Ltd. |

| 201 | Wellington-Altus Private Wealth Inc. |

| 203 | Assante Capital Management Ltd. |

| 204 | Foster & Associates Financial Services Inc. |

| 205 | Lightyear Capital Inc. |

| 207 | Gravitas Securities Inc. |

| 208 | Kingwest and Company |

| 217 | Kingsdale Capital Markets Inc. |

| 218 | Emerging Equities Inc. |

| 221 | INFOR Financial Inc. |

| 222 | JP Morgan Securities Canada Inc. |

| 226 | Chippingham Financial Group Ltd. |