Inflation is the increase in the general price level of goods and services in an economy over a period of time. When the general price level rises, each unit of currency buys fewer goods and services; consequently, inflation reflects a reduction in the purchasing power of money – a loss of real value in the medium of exchange and unit of account within an economy. A chief measure of price inflation is the inflation rate, the annualized percentage change in a general price index (normally the consumer price index) over time.

Inflation can be caused by a variety of factors, including changes in the money supply, changes in the cost of production, and changes in government policies. One way that inflation can be caused is through the process of legal counterfeiting, also known as “monetary expansion.”

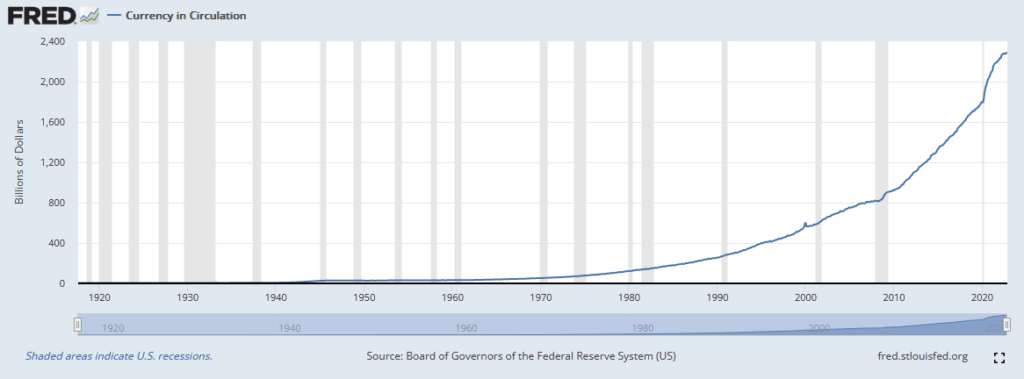

Legal counterfeiting occurs when a central bank, such as the Federal Reserve in the United States, increases the money supply through the creation of new money. This is typically done by purchasing government securities or making loans to banks, which then use the newly created money to make loans to businesses and individuals. The increase in the money supply can lead to an increase in spending, which can drive up the price of goods and services and result in inflation.

While legal counterfeiting can be a tool for central banks to stimulate economic growth and combat deflation, it can also have negative consequences if not properly managed. If the money supply is increased too quickly, it can lead to rapid inflation and a loss of confidence in the currency. This is why central banks typically aim to maintain a low and stable inflation rate through the use of monetary policy tools such as setting interest rates.

In summary, inflation is the general increase in the price level of goods and services in an economy over time, and it can be caused by legal counterfeiting, or the process of increasing the money supply through the creation of new money by a central bank. While this can be a useful tool for economic stabilization, it must be carefully managed to avoid negative consequences such as rapid inflation and a loss of confidence in the currency.

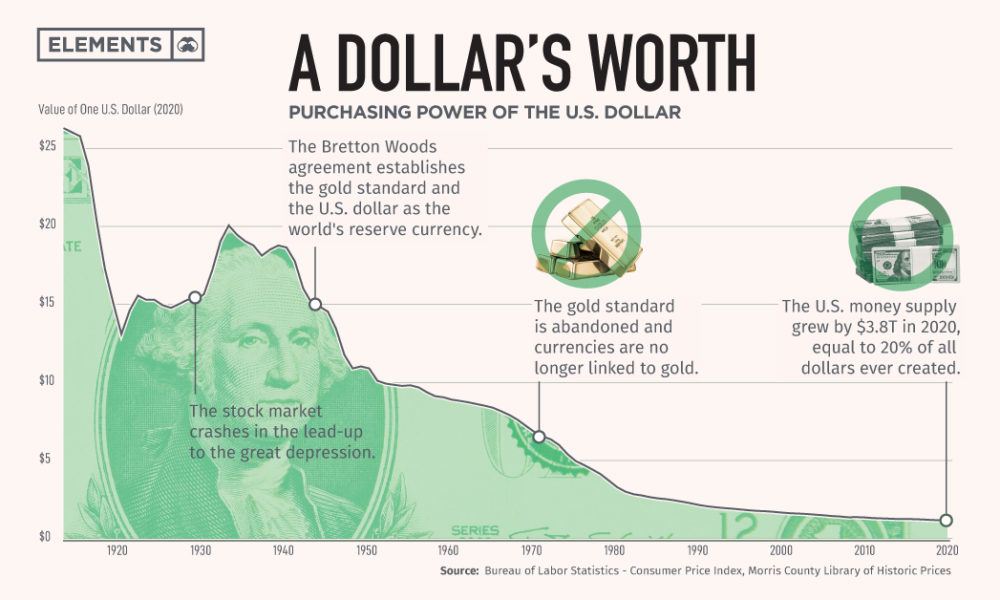

Printing more money can be considered a form of theft in some cases because it can lead to a decrease in the value of people’s savings and investments. When the money supply is increased, it can lead to an increase in the overall price level of goods and services in an economy. This means that each unit of currency is worth less in terms of the goods and services it can purchase, which can lead to a decrease in the purchasing power of people’s money.

For example, let’s say that someone has saved $100 and the overall price level in the economy remains stable. In this case, that person’s $100 would be able to purchase the same amount of goods and services as it could have before. However, if the money supply is increased and the overall price level in the economy rises, the value of that person’s $100 will decrease. It will be able to purchase fewer goods and services than it could before, resulting in a loss of purchasing power.

This can be seen as a form of theft because the person’s savings have been effectively taken from them through the process of inflation. While the person still has the same amount of money, it is worth less in terms of the goods and services it can purchase. This can be particularly harmful for people who rely on their savings for financial stability, such as retirees who live on a fixed income.

It is important to note that not all increases in the money supply necessarily lead to inflation, and central banks often use monetary policy tools such as setting interest rates to manage the money supply and maintain a low and stable inflation rate. However, if the money supply is increased too quickly or without proper management, it can lead to a loss of value in people’s savings and investments and be considered a form of theft.

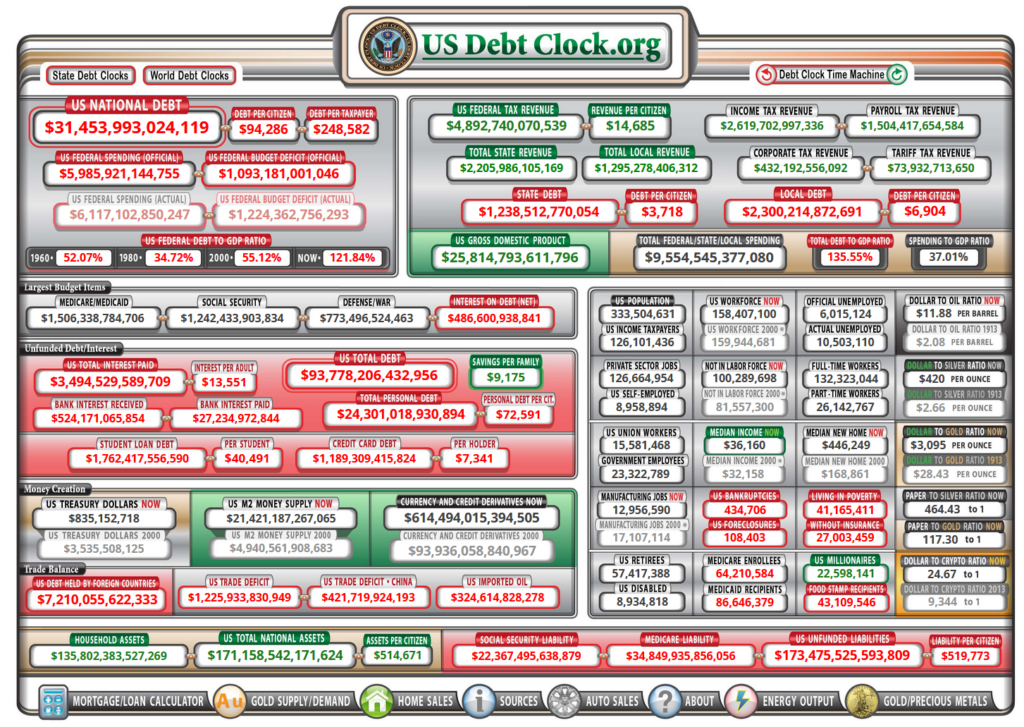

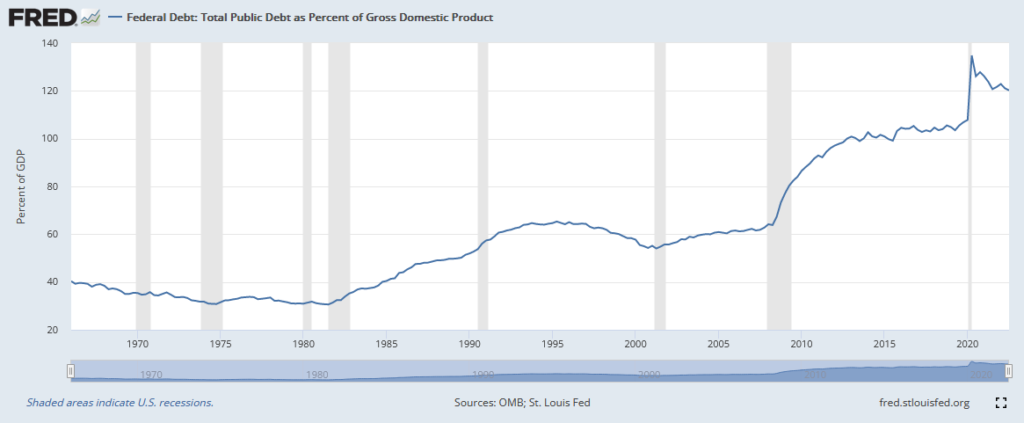

Although the United States dollar (USD) is the world’s reserve currency, and it has played a dominant role in the global economy for decades. There are concerns that the USD could potentially crash due to excessive money printing by the Federal Reserve, the central bank of the United States.

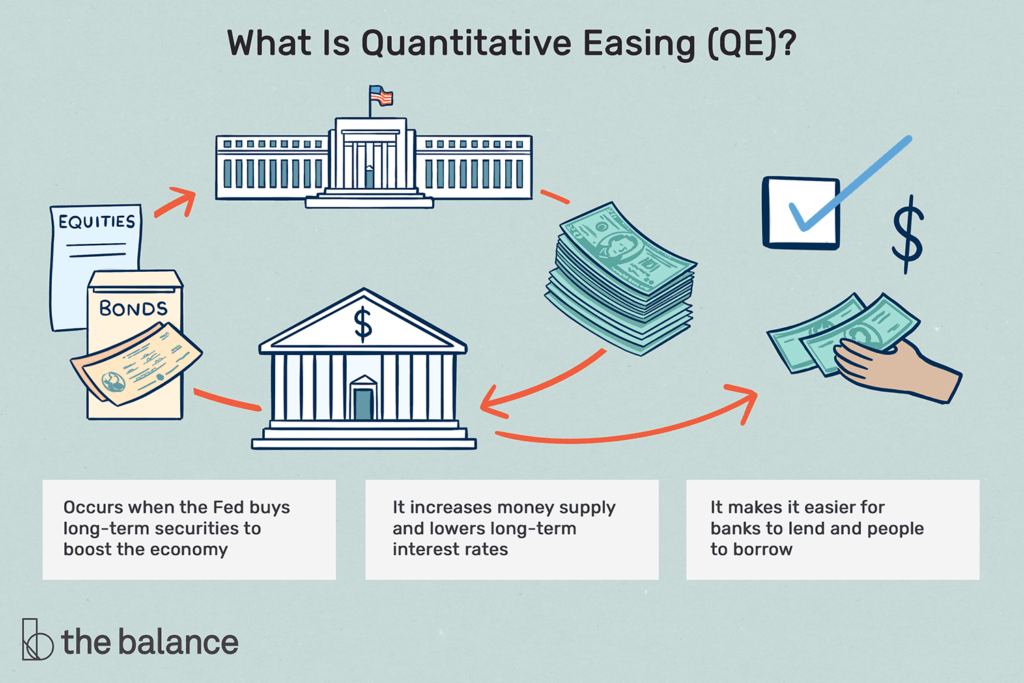

One of the main drivers of this potential crash is the Federal Reserve’s response to the COVID-19 pandemic. In an effort to support the economy and mitigate the impact of the pandemic, the Federal Reserve has implemented a number of monetary policy measures, including several rounds of quantitative easing (QE). QE involves the Federal Reserve buying financial assets, such as Treasury bonds, from banks and other financial institutions, with the goal of increasing the supply of money and lowering borrowing costs.

While QE has been effective in supporting the economy and financial markets in the short-term, there are concerns that it could have negative consequences in the long-term. One potential consequence is inflation, which is an increase in the general price level of goods and services. If the Federal Reserve continues to print money at an unsustainable rate, it could lead to a situation where the supply of money significantly outpaces the demand for goods and services, resulting in higher prices and devaluation of the USD.

Another concern is that the Federal Reserve’s QE program could lead to asset bubbles, which are inflated prices of assets that are not justified by the underlying economic fundamentals. For example, the stock market has experienced a significant rally since the start of the pandemic, which some analysts attribute to the Federal Reserve’s QE program. If these asset bubbles burst, it could have negative consequences for the economy and the value of the USD.

In addition to QE, the Federal Reserve has also implemented a number of other monetary policy measures, such as low interest rates, to support the economy during the pandemic. While these measures have been effective in the short-term, there are concerns that they could lead to financial instability in the long-term, potentially contributing to a crash of the USD.

It’s important to note that the potential for a USD crash is not a certainty, and there are many factors that could impact the value of the currency. However, the Federal Reserve’s monetary policy measures, particularly QE, have raised concerns about the long-term stability of the USD and the potential for a crash. It will be important for policymakers to carefully consider the potential consequences of their actions and to take a balanced approach in managing the economy and financial system.