The BRICS countries are a group of emerging economies that includes Brazil, Russia, India, China, and South Africa. These countries have experienced significant economic growth in recent years and have become major players in the global economy. Some of the BRICS countries have chosen to use gold to back their currencies, in order to provide a stable and reliable store of value and reduce the risk of currency devaluation or inflation.

One of the main advantages of using gold to back a currency is that it can provide a stable and reliable store of value. Gold has a long history of being used as a medium of exchange and a store of wealth, and it is widely recognized and accepted around the world. As such, using gold to back a currency can help to reduce the risk of currency devaluation and inflation, and it can provide a measure of stability and predictability to the currency’s value.

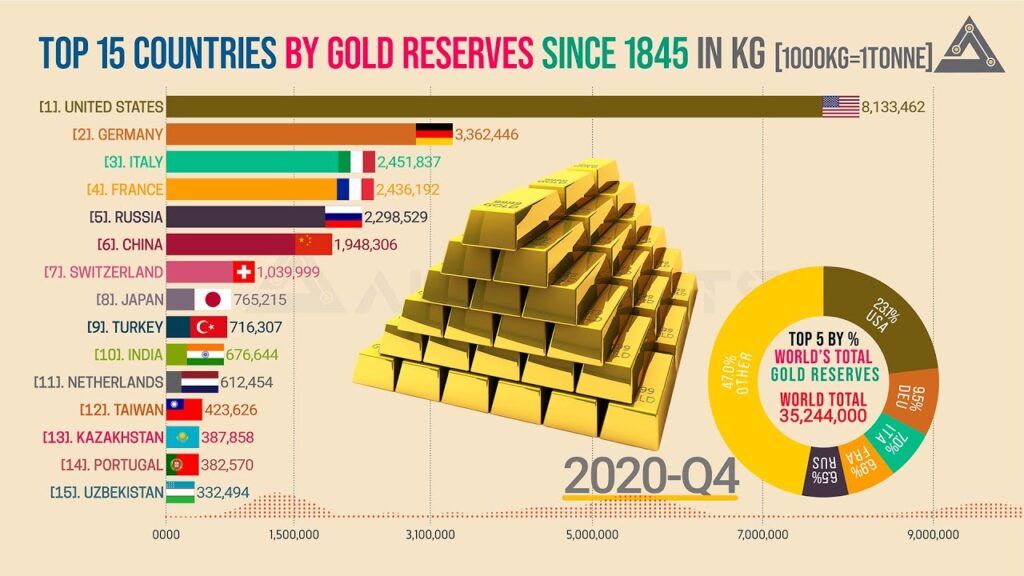

Several of the BRICS countries have chosen to use gold to back their currencies, including Russia and China. Both of these countries have established central banks that hold large reserves of gold and use them to back the value of their currencies. By holding gold reserves, these countries are able to maintain the value of their currencies and reduce the risk of currency devaluation or inflation.

“BRICS must provide a united and clear voice in shaping a peaceful, balanced and stable world. We must harness each other’s strengths, in knowledge, skills and resources.”

Narendra Modi

In addition to using gold to back their currencies, the BRICS countries also use a combination of other currencies and assets to maintain the value of their currencies. These may include US dollars, euros, and other major world currencies, as well as sovereign bonds and other financial instruments. By using a basket of currencies and assets to back their currencies, these countries are able to diversify their risk and reduce the impact of fluctuations in any single currency or asset.

Overall, the use of gold to back a currency can provide a measure of stability and reliability to the currency’s value. By holding gold reserves and using them to back their currencies, the BRICS countries are able to maintain the value of their currencies and reduce the risk of currency devaluation or inflation.

- Gold has a long history of being a safe haven asset: Gold has been used as a store of value for centuries, and it is often seen as a safe haven asset during times of economic uncertainty or financial market volatility. When investors are worried about the stability of other financial assets, such as stocks or bonds, they may turn to gold as a more stable and reliable investment. This can lead to increased demand for gold, which can drive up its price.

- Central banks are increasing their gold reserves: Many central banks around the world have been increasing their gold reserves in recent years, which can be seen as a vote of confidence in the metal. When central banks hold more gold, it can indicate that they see it as a valuable and reliable asset, and this can increase demand for gold and contribute to its bullish trend.

- Gold is a hedge against inflation: Gold is often seen as a hedge against inflation, as it tends to maintain its value over time, even when the value of other assets and currencies is decreasing due to inflation. This can make it a particularly attractive investment during times of high inflation, as it can help to protect the value of an investor’s wealth.

- Interest rates are low: Low interest rates can be bullish for gold, as they can make it less attractive for investors to hold cash or other low-yielding assets. When interest rates are low, investors may be more likely to seek out alternative investments that offer higher returns, such as gold.

- Political and economic uncertainty: Gold can also benefit from increased political and economic uncertainty, as investors may turn to it as a safe haven asset during times of uncertainty. For example, if there is a significant geopolitical crisis or a major economic downturn, investors may flock to gold as a way to protect their wealth. This can drive up the price of gold and contribute to a bullish trend.

In recent years, there has been growing interest in the possibility of the BRICS countries – Brazil, Russia, India, China, and South Africa – taking over the role of the world reserve currency. While the U.S. dollar currently holds the dominant position, with about 60% of global foreign exchange reserves, there are several reasons why the BRICS countries could be well-suited to take over this role.

One advantage of the BRICS countries is their size and economic potential. Collectively, these countries represent a significant portion of the global economy, and their economies are expected to continue growing in the coming years. This makes them attractive to investors and could increase their influence on the global stage.

Another advantage of the BRICS countries is their diverse economic profiles. While the U.S. is heavily reliant on the service sector, the BRICS countries have a more diverse range of industries, including manufacturing, agriculture, and natural resources. This diversity could make them more resilient to economic shocks and give them a stronger foundation for long-term growth.

Additionally, the BRICS countries have been working to increase their economic and political influence in recent years. This includes initiatives such as the creation of the New Development Bank, which is intended to provide financing for infrastructure projects in emerging economies. These efforts could increase the attractiveness of the BRICS countries as a global reserve currency and increase their influence in the global financial system.

It is important to note that the transition to a new world reserve currency would not happen overnight and would likely be a gradual process. However, the BRICS countries have the economic and political potential to eventually take on this role.

In conclusion, there are several reasons why the BRICS countries could be well-suited to take over the role of the world reserve currency. Their size, economic potential, and diverse economic profiles make them attractive to investors, and their efforts to increase their influence could make them a more viable alternative to the U.S. dollar as a global reserve currency. While the transition to a new world reserve currency would likely be gradual, the BRICS countries have the potential to eventually take on this role.