Top 5 Crypto Coins for 2021

Meta Description: Amongst the several cryptocurrencies that exist, picking the Top 5 Crypto Coins in 2021 is not an easy task. However, after careful research, we have discovered the Top 5 Crypto Coins to invest in in 2021. Bitcoin. BTC. Cryptocurrencies. Crypto coins. Ethereum. ETH. XRP. Dogecoin.

Introduction

Cryptocurrencies were invented to change the game in the financial system, to make the system decentralised. To a very large extent, they have succeeded greatly in making an impact in the sector. Globally, users transact billions of dollars worth of value daily all powered by crypto coins. The idea of cryptocurrencies is also facilitating innovation in everything from NFTs to decentralised finance or DeFi.

Cryptocurrencies (Source: Pixabay)

As a result, there is a strong demand for crypto coins. They have attracted a lot of speculative activity. So far in 2021 in particular, cryptocurrencies have experienced a lot of volatility, rising across board to all time highs. Cumulative crypto market cap has now topped $2 trillion. It may appear that there are no longer opportunities for good returns in the market, but that is not the case. Indeed, a lot of opportunities can be derived from the market in 2021.

Specifically, we have identified some crypto coins that we term the top crypto coins in 2021. These coins have been selected considering a wide variety of criteria ranging from fundamentals and history to potential. The top 5 Crypto Coins in 2021 are XRP, ETH, QNT, MATIC and OMI.

RIPPLE (XRP)

XRP is built to facilitate payments. It is the main digital asset on the XRP Ledger, an open-source, decentralized, and permission-free blockchain technology that settles transactions in record time. Users can send XRP directly to others without needing a central intermediary, making it a convenient instrument for bridging two different currencies as quickly and efficiently as possible.

XRP Chart, August 12, 2021. (Source: Coinmarketcap.com)

Ripple (XRP) was built by Ripple Labs which was founded by Chris Larsen and Brad Garlinghouse. Both founders are tech veterans and investors, and alumni of Stanford and Harvard, respectively. The reasons why XRP ranks as top crypto coin in 2021 are numerous, but we will consider three:

- Cross-Border Payments

The cross-border payment system is broken. Funds sent from one country to another can take several days, if not weeks, to get reflected in the other country. However, Ripple has created a technology that delivers these payments in the shortest amount of time ever. Transactions that are carried out through the XRP blockchain can be completed in less than a minute. In some cases, you have as short as ten seconds.

As a result, everyone from leading banks to international payment platforms have entered into partnerships with Ripple to enable them use its technology for remittances and payments, trade settlements, and facilitating financial contracts. These partners include American Express, MoneyGram, Ria, Bank of America, Standard Chartered Bank, the Royal Bank of Canada, and many more.

- Fast and Scalable

XRP is incredibly fast, even by cryptocurrency standards. It is one of the fastest cryptocurrencies out there. For instance, within 0.07 minutes (or less than 4 seconds), you can get your trades done. Due to this extraordinary speed, XRP is exceedingly scalable, as more transactions can be settled overtime. It has the power to settle as many as 1,500 transactions every second. Conversely, BTC can handle only a maximum of 6 transactions per second.

- Level of Distribution

XRP is built on the blockchain. That means its ledger is distributed across at least 150 validator locations all over the globe. Thus, it is extremely secure.

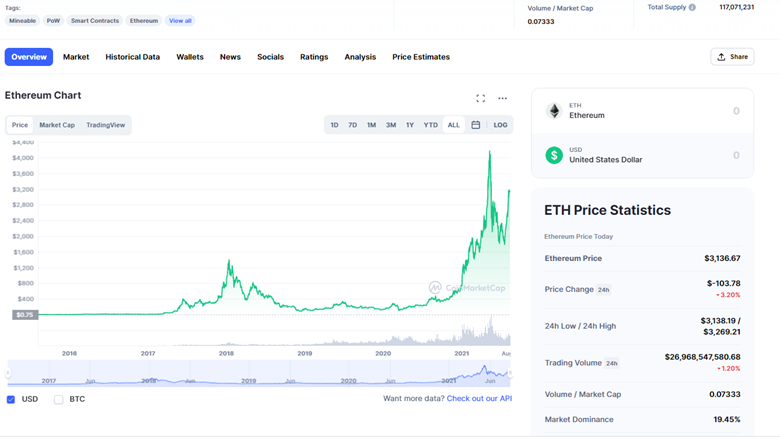

ETHEREUM (ETH)

Ethereum most likely needs no introduction. It is the second preeminent cryptocurrency after Bitcoin. It was founded in 2015 by a group of crypto developers led by the now crypto billionaire, Vitalik Buterin. The coin has rallied above $400 billion in market cap, and is probably the token with the most widespread adoption.

Ethereum Chart, August 12, 2021 (Source: Coinmarketcap.com)

There is a difference between Ethereum and Ether. Ethereum is the blockchain platform that powers several technologies while Ether (ETH) is the token used for transactions on the blockchain. Because of the many strong fundamentals it possesses, buying Ether (ETH) is a no-brainer. However, we will still point out two major reasons why you must buy ETH. These reasons are:

- The Platform

The most fundamental reason why ETH is a compulsory buy is its Ethereum platform. The ERC protocol can be said to be the backbone of the blockchain technology. This is because it is the main platform for the development of all other blockchain applications. Most tokens are built on Ethereum’s blockchain. The same is the case for NFTs and DApps. The platform hosts the smart contracts that facilitate transacting in those assets.

These technologies are experiencing a boost in ever-increasing adoption. They all need the ETH token to conduct transactions on the Ethereum platform so the token is a good buy.

- Institutional Adoption

Ethereum use is just not limited to crypto enthusiasts. The big corporations are now onboard as well. Intel, JP Morgan, Microsoft, Reuters, BP and tens of other Fortune 500 companies are on the Enterprise Ethereum Alliance (EEA). The EEA-member companies aim to incorporate Ethereum adoption into their operations.

Bank of America is facilitating payments using Ethereum. Also, MasterCard, UBS and JP Morgan jointly invested in ConsenSys, a development studio building tech based on Ethereum Blockchain.

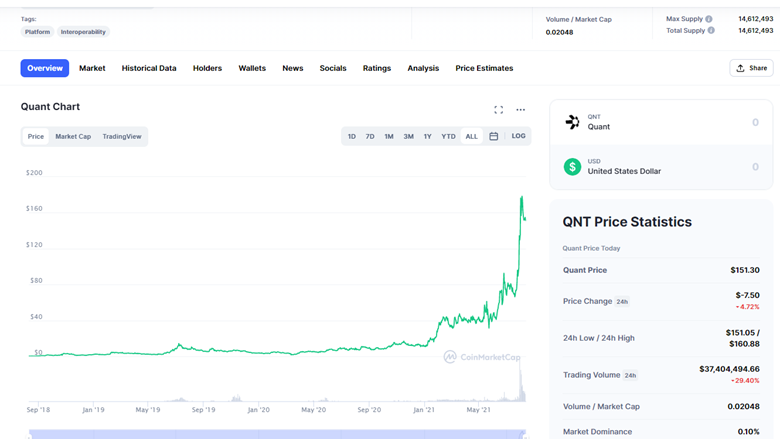

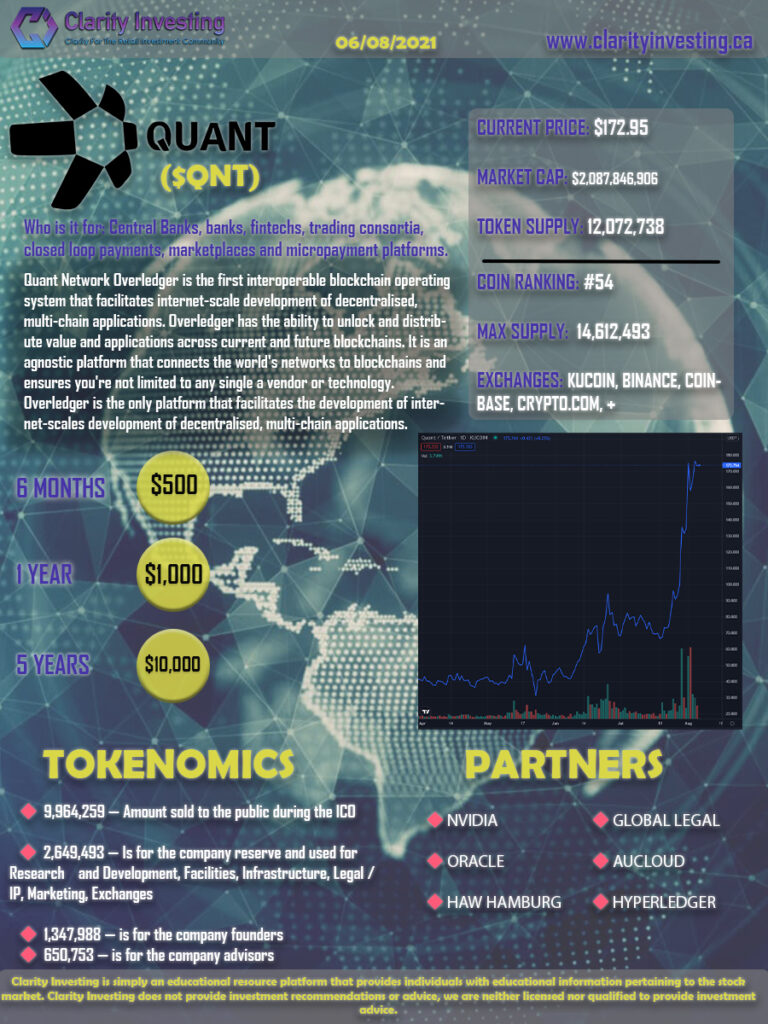

QUANT (QNT)

The revolution brought about by Blockchain has now been applied in industries from cryptocurrencies to NFTs and DApps. However, a huge problem still being faced in this space is that products are not integrated-operable; in essence, they do not work together. To fix this problem, amongst others, Quant developed the OverLedger network to make blockchain interoperable. Quant connects multiple decentralised ledger technologies together so that users can exchange value across various protocols and technologies. Prominent among the users of Quant are institutions. Quant (QNT) is the token used in the network.

Quant Chart, August 12, 2021 (Source: Coinmarketcap.com)

Quant was founded by Gilbert Verder, a blockchain veteran with experience building decentralized technologies. He has spent time at the Bank of England, Federal Reserve System, PWC, Ernst & Young, and MasterCard. He is the founder of the Blockchain ISO Standard TC307. There are plenty of reasons to invest in QNT, but we will outline only a few:

- Topnotch Partners

In deploying its interoperability platform, Quant has developed partnerships with leading brands and institutions. These include the innovative chip maker, Nvidia, cloud computing giants, Oracle and Amazon Web Services, and the Blockchain Consortium, amongst several others. These partners will help the network garner the needed credibility to achieve scale.

- Sectors and Products

In addition to facilitating interoperability, Quant is bringing decentralization-driven innovation to other sectors. These include healthcare where it has launched Quant Health to make healthcare information management secure and accessible.

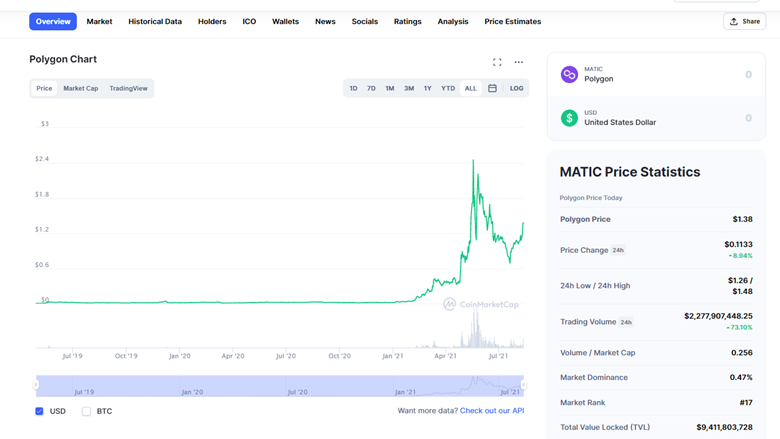

POLYGON (MATIC)

To further broaden Blockchain applications, the Ethereum platform was optimised to facilitate the creation of new products known as smart contracts upon which decentralized applications (DApps) are built. However, a huge problem that faced (and still facing) the Ethereum and Bitcoin networks is that they are not optimised to take on large transactions, as they are slow, and thus expensive.

Polygon Chart, August 12, 2021 (Source: Coinmarketcap.com)

That brought about the need for Polygon, a scaling solution protocol for DApps. It can handle transactions in just a few seconds, at fractions of cents. Polygon (MATIC) is the token used to facilitate transactions in this network. The network was developed by the trio of Jayanti Kanani, Sandeep Nailwal, and Anuraj Arjun, who are software engineers, with stints at Deloitte and Cognizant.

Why should you buy MATIC? Consider the following reasons:

- Boom in Decentralised Applications

The boom in cryptocurrencies has brought about the application of the technology upon which they are based (that is, blockchain) to other facets of life. We now have DApps which mirror real-life traditional ways of life and create a decentralized, blockchain-based version of them. Since inception, DApps have boomed to unprecedented heights and surprisingly, it appears the boom is just about to start. This boom in DApps and their finance variety, that is Decentralized Finance (DeFi), is driving demand for protocols such as Polygon as well as its underlying token, MATIC.

- Partnerships and Endorsements

The management behind Polygon is not resting on its oars, as it is facilitating partnerships with big players in the blockchain and DApps space. In 2021 alone, leading networks, Graphlinq and Kyber Network, have listed MATIC as partnering tokens. Multi-billion dollar crypto asset manager, Grayscale, has added MATIC to its portfolio, with a view to creating an investment product out of it.

- New Products

The Polygon team is working on releasing new technology that will further drive up demand and adoption. There is the Polygonscan, a blockchain explorer; Polymarket, an information market; API3, an API platform for Web 3.0; Biconomy, a next-generation digital economy platform, and much more.

ECOMI (OMI)

Blockchain has transformed the way we understand currencies, and is gradually bringing about the same transformation in how we relate with value. Assets are being digitised and made virtual. Evidence of this is seen in the boom of what is known as Non-fungible Tokens (NFTs). NFTs have grown in popularity, adoption, value, and importance since inception, with various digitised assets attracting multimillion dollar valuations.

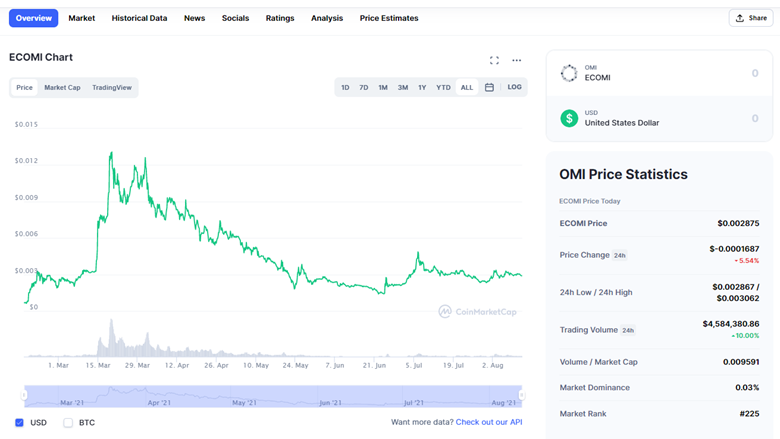

ECOMI Chart (Source: Coinmarketcap.com)

ECOMI was created to leverage on this new trend. It does so in many ways. First, it is an NFT licensee selling original NFTs; it is also an NFT Marketplace facilitating the trade in NFTs. Furthermore, it has a slew of other products that improve how things are done in the NFT industry. ECOMI (OMI) is the token that facilitates transactions on the platform.

There are several reasons why OMI is a buy. Three of them are:

- High Number of Licenses

ECOMI has secured one of the highest numbers of licenses for digital collectibles. It owns the NFT licenses for Superman, Batman, The Joker, Street Fighter, Star Trek, and Jurassic Park. The above are some of the most remarkable brands across their various categories and will surely attract heavy demand for the OMI token.

- Product Releases

As against other NFT marketplace, ECOMI owns an actual product which is the ECOMI wallet, a wallet for storing, transacting, validating, and managing your digital collectibles. It owns the VeVe app, a fast-growing NFT marketplace. Then, there is its one-of-a-kind hardware wallet, which rather than store only cryptocurrencies, provides cold storage for everything from crypto coins to NFTs and DApps. All of these will boost activity in the OMI token, the platform’s crypto coin.

- GoChain

Most other DApps and smart contracts are built on the Ethereum Blockchain, but it is bedevilled with problems from its slowness to its high fees. OMI works on the GoChain to avoid all these problems, and therefore prove very attractive to users.

There are over 5,000 tokens and coins. However, not all are worth investing in. Hence, you should only go for the ones with strong fundamentals, wide adoption, and promising features. Discovering these top crypto coins might be difficult but we have done the hard work for you. Strongly consider making these coins a part of your 2021.