Ortho Regenerative Technologies, Inc.

Meta description: Ortho Regenerative Technologies Inc., is an emerging orthobiologics company that develops novel therapeutic tissue repair technologies. Here is everything you need to know about it.

Introduction and Overview

The International Labour Organization (ILO) estimates that over 1 million persons encounter severe occupational injuries per annum. And while the success rate of surgeries for those injuries is between 50% and 75%, it is recorded that only about 7% of patients fully return to the state they were before those accidents.

In a similar vein, 8 million people encounter severe sports injuries, and although most are treated, a great many of them do not get restored to their previous states. This underscores the need for a field like regenerative medicine the purpose of which is to facilitate the repair or regrowth of damaged tissues or organs. As the name suggests, it involves regenerating and restoring human tissues and cells to achieve normal functions.

Regenerative Medicine.

Regenerative medicine as a field is still in its infancy. As a result, many biotechnology companies are still developing innovative regenerative medicine products and systems in a bid to commercialize them. One of them is Ortho Regenerative Technologies Inc.

Founded in 2015 and based in Quebec City, Canada, Ortho Regenerative Technologies operates as an orthopedic biotechnology firm. The company specializes in the development of novel therapeutic tissue repair devices which are aimed at improving patients’ lives through increasing the success rates of surgeries for soft tissue injuries.

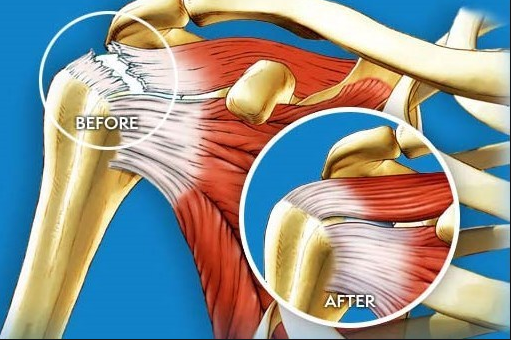

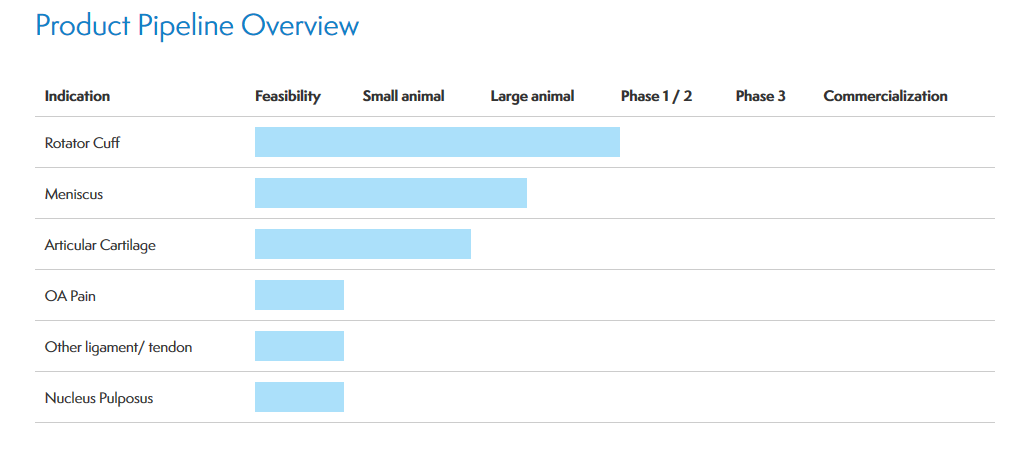

Towards achieving this goal, it has developed ORTHO-R, a hybrid biologic implant combination drug aimed at increasing the healing rates of occupational and sports-related injuries to tendons, menisci and ligaments. It has also built a proprietary technology platform called RESTORE designed to augment and guide the regeneration of new tissues in various musculoskeletal conditions.

There are many products in the pipeline aimed at improving cartilage repair, bone void filling and facilitating osteoarthritis treatment. The company plans to commercialize these technologies by developing treatments for rotator cuff injuries which are prevalent in the US sports industry. Most of these products are undergoing clinical trial, while none has been approved yet. Ortho Regenerative Technologies is listed on the Canadian Securities Exchange (CSE) under the ticker, ORTH. It was recently listed on the US over-the-counter ventures market, the OTCQB under the symbol, ORTIF.

Company Strengths and Opportunities

- Innovation

Ortho Regenerative Technologies Inc. has deployed innovation in coming up with a combination product to facilitate the healing of sports injuries. Furthermore, it has developed a do-it-yourself technology to bring about the regeneration of new tissues, potentially saving patients several dollars and time that would have been expensed on doctor visits. All of these technologies are patented.

If they pass clinical trials, the upsides will be enormous.

- Strategic Partnerships

Being innovative but relatively small, the company lacks on a number of fronts. These include access to quality research and development resources as well as talent. However, the company has been able to reduce this gap by entering into strategic partnerships with reputable persons and institutions in the life sciences space.

Most notable of this is its agreement with Hanuman Pelican Inc, which gives it exclusive right to combine Hanuman’s Buoy Suspension Fractional System with Ortho’s own products to make its product development process faster. There are other high-level partnerships entered into with bigger biopharma companies, consulting firms and the academia.

- Quality Management

Ortho is run by a team of qualified professionals who have garnered requisite experience in different aspects of the industry. From the management team to the board of directors and the technical advisory board, the company features individuals with expertise in life sciences, some of whom have been involved in bringing innovative biopharmaceutical products to the market.

Quality management will be useful in navigating industry problems, and developing strategic partnerships with resource persons and institutions.

- The United States of America

Ortho is based in Canada, and it is expected that the country will be its primary market. However, the company has also been working on launching its products in the USA, as it has received the US FDA approval to go on with clinical trials for its rotator cuff tears repairs. This is a commendable move in the right direction.

While the Canadian market shows a lot of promise, it is much smaller than that of the USA. A significantly larger population, large investments in regenerative medicine, and potential high growth rates in the regenerative medicine market, make this move into the USA a highly strategic one.

- Market Opportunity

As noted above, the regenerative medicine industry shows a lot of promise, both in the mid and longer terms. It is expected to reach over $17 billion in 2025, from $8.5 billion in 2020. This represents an average growth rate of over 16%. It is instructive to note that the tissue-engineered and musculoskeletal products segment in which Ortho specialises, accounts for the largest share of the market.

Even more instructive is the fact that the North American region is the largest share of industry, by geography. This puts Ortho Regenerative Technologies in the best place to capitalise on the still-unfolding industry. Also, there is the opportunity to expand to other regions, especially Asia which is poised to experience the fastest growth rates in the mid-term.

Generally, the COVID-19 pandemic and circumstances surrounding it, have led to an increase in investors’ interest in biotechnology. Even beyond the pandemic, this interest is likely to be sustained.

- Research and Development

A great deal of the company’s innovation can be linked to its rigorous research and development (R&D) efforts. To do proper R&D, the company devotes a great deal of human and material resources; for instance, its finances reveal that a third of its spending goes to R&D. It works hand-in-hand with a lot of technical advisors and institutions, who are experts in the space.

Company Weaknesses and Risks

Despite appearing to be a promising firm, some internal and external factors make Ortho a higher risk for investing.

- Finances

So far, the company has not generated any revenue. Meanwhile, it has been recording losses in the millions. Being an innovative biotech company, this is quite understandable as it is not out of place for comparable companies.

- Valuations

With market cap at around $25 million, Ortho is fairly valued but this can change as they hit future milestones. Furthermore, small cap stocks can present high volatility for investors as they can experience wild price moves in very short periods.

SHARE STRUCTURE

According to the Canadian Securities Exchange (CSE), Ortho Regenerative Technologies share structure is presented thus:

Issued & Outstanding: 34,453,600

Reserved for Issuance: 31,992,282

CURRENT FINANCIALS

The latest financial filing by the company was the Q3 2020 financial statements for the nine months ended September 2020. As mentioned above, it has not generated any revenue so far, but it has generated expenses to the tune of $2.5 million. This represented an increase of 25% over the figure recorded for the 9-month period ended September 2019.

In essence, Ortho recorded losses of $2.5 million for the 2020 9-month period. 30% of the company’s expenses (and therefore, losses) went to research and development, whilst 40% was spent on general and administrative expenses. Financing expenses (interest payments) took up roughly 20%, while less than 8% went to share-based compensation. Notably, there was a 300% increase in financing expenses over the previous comparable period. Net cash-flow for the period was a positive $507,000, a 270% over the previous one.

From the foregoing, however, some points have to be noted. For one, the company is heavily reliant on short-term debt financing which may place some burden on cash-flow in the short term. Hence, it has to find ways to generate sustainable cash-flow to wean itself off reliance on debt and fund its operations. Nevertheless, the company’s current financing strategy must be commended. Taking on convertible debentures is a viable option for fundraising, especially in the face of lack of equity funding – which is generally deemed as preferable for companies such as this.

With convertible debenture financing, creditors can convert easily to shareholders, especially in case of default. It is quite noteworthy as well that a tidy percentage of the expenses and losses are due to heavy investments in research and development. However, although this has not reflected in its books, it must also be noted that the company recently secured additional financing of $3 million in the form of secured non-convertible debenture. In the past year, the company has focused on raising financing through private placements. This is expected to strengthen its books and give it needed liquidity in the midterm.

CURRENT PROJECTS

Ortho has been involved in several projects that are targeted towards delivering on its goal of bringing innovative therapeutics to the market. First, the company has got the approval of the United States Food and Drug Administration (FDA) to carry out first and second-phases clinical trials for their rotator cuff tears repairs system in the US.

Furthermore, it has announced a global license agreement with Hanuman Pelican, Inc, a company that specialises in the production of novel medical therapeutics. The deal confers on Ortho Regenerative Technologies the rights to commercialize Buoy Suspension Fractional System developed by Hanuman, in combination with the Ortho-R, the company’s hybrid implant combination product. In return, Ortho Regenerative will pay royalties to Hanuman for all net-sales of the Buoy Suspension Fractional System.

These announcements and projects represent major milestones in bringing the company’s products to the market.

MANAGEMENT

Ortho is led by an array of industry veterans who have garnered cognate experience in leading life sciences companies.

Michael Atkin, Chairman.

Atkin boasts over 30-year experience in the life sciences space – specifically in the pharmaceutical and biotech industries. A pharmaceutical veteran, combining rich domain expertise with top-notch business acumen, he builds and scales life sciences companies. He is an entrepreneur, startup developer, manager and boardroom maestro, focusing on the commercialization of life science innovations. He has led several companies, fostered partnerships and brought many innovations to the market.

He was CEO of Ulysses Pharmaceuticals which specialised in developing drugs to fight antibiotic resistance. He was also CEO of Aegera Therapeutics which focused on apoptosis control; while here, he oversaw the raising of financing to the tune of $33m, and brought two novel drugs to the market. At Aegera, he also facilitated the development of partnerships with major biopharma firms which led to notable project breakthroughs and millions of dollars in revenue.

Atkins was Chairman of Sopharmia Inc, an antibiotic chemistry startup, which was later sold to Gladius Pharmaceuticals. As a result, he became the CEO of Gladius, leading the company between 2015 and 2019. He is currently the President of Syzent Partners Ltd, a life sciences consulting firm with head office in Montreal, QC. He holds an MBA from the Columbia Graduate School of Business.

Claude LeDuc, CEO.

Mr. LeDuc has garnered over three decades of top-notch experience in the medical, biotech and pharmaceutical industries. In those years, he has occupied senior-level positions, having several times served as CEO and COO in both private and Fortune 500 companies such as Genzyme, Biomatrix, Serono and BioSyntech.

In between these companies, Mr. LeDuc has secured over $50 million in financing. He specifically oversaw the public listing of BioSyntech in 2004. Mr LeDuc has spearheaded the development of innovative solutions, especially in the regenerative medicine space, and has built partnerships with key individuals and institutions in the industry.

In addition to core technical expertise, Mr. LeDuc has built experience in sales, marketing, commercialization, strategy, management, business development and startups.

Luc Mainville

Mr. Luc Mainville has built an illustrious career in finance and operations, especially in the life sciences industry. Specifically, he has spent over two decades in executive management positions in life sciences firms including Neopharm Labs, Cardiome Pharma, Acerus Pharma, and LAB Research Inc, amongst others. In these firms, he has been CEO, CFO, Chairman, Board Member and President.

In the course of his career, Mr. Mainville has been involved in several financing deals including initial public offerings, mergers and acquisitions, licensing, and capital raising. Before his foray into the life sciences industry, Mr. Mainville was at KPMG where he rose to Partner. He holds an MBA from McGill University and currently serves as Senior Vice President and CFO at Valeo Pharma.

RESEARCH

ORTHO REGENERATIVE TECHNOLOGIES INC – (ORTH.CN).

ORTHO REGENERATIVE TECHNOLOGIES INC – (ORTIF.OTCQB).

ORTHO REGENERATIVE TECHNOLOGIES – About Us.

ORTHO REGENERATIVE TECHNOLOGIES – Management Team.

ORTHO REGENERATIVE TECHNOLOGIES Financial Statements, Q3 2021.

ORTHO REGENERATIVE TECHNOLOGIES INC – SEDAR Filings.

ORTHO REGENERATIVE TECHNOLOGIES INC – Canadian Securities Exchange.