“Rule No.1: Never lose money. Rule No.2: Never forget rule No.1” – Warren Buffet

Learning to take small losses is a mindset every trader needs to grasp in order to become a consistent profitable trader, and one of the most important aspects to focus on while in the learning stage of your trading career. Your trades need to be planned, where the upside and downside are carefully calculated and allowing your winners run and your losers cut quick. Setting a stop loss and using a risk/reward ratio to calculate potential losses and profits is something experienced traders take into account to maximize profits and minimize losses.

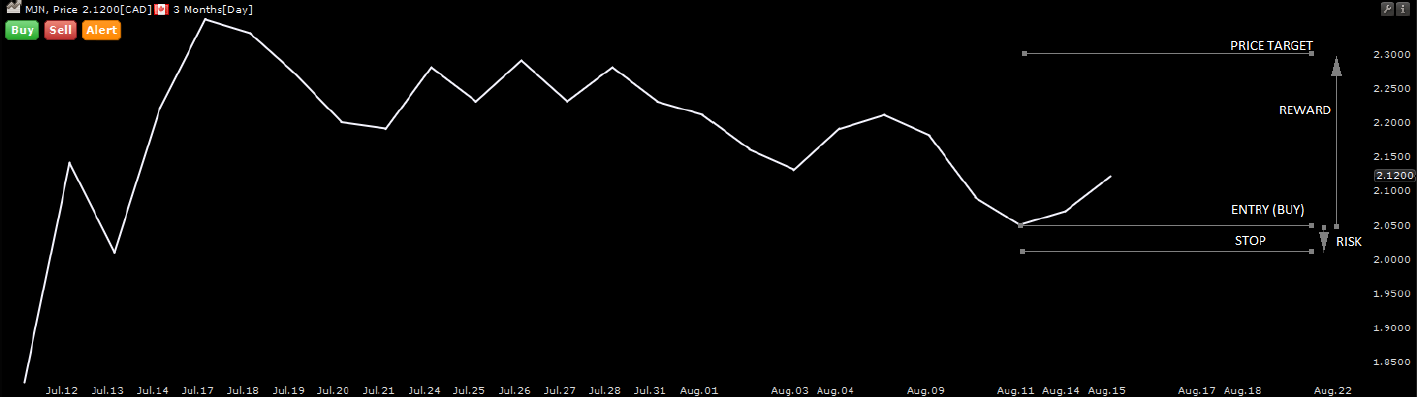

Breaking down the risk/ reward ratio:

The risk/ reward ratio is calculated by dividing the potential loss (your risk) by the potential profit you stand to make when you close your position (your reward). First step is to place a stop loss, going back to my article on “Determining Position Size” your stop loss is known as your trade risk. You want to place your stop loss outside of support levels or normal market movement range. Next you need to set a price target, you can use key resistance levels to determine where your price target will be but If there is no historical price action, phycological levels will be your next key

target. A common risk/reward ratio to use is 1:3, with this ratio you are risking $10 to make $30. For example purposes if you purchased 1000 shares at $10 with a stop loss

at $8, using a 1:3 risk/ reward ratio your price target will be $16. You will be risking $2000 to make $6000. The ability to cutting losses quick is what sets the profitable

traders apart from everyone else, having big winning trades and small losing trades is what will give you the chance to trade another day. Big losses are the primary reason

most new traders are unprofitable.

Below is a graph that visually lays out the risk/ reward ratio using a stop loss and price target.