Becoming an “Accredited Investor”

When you look at investors from the perspective of regulatory frameworks, they generally fall into two categories. There are accredited and unaccredited investors. Accredited investors are those investors, either individuals or business entities, that financial authorities allow to deal in investments that may not be registered with them. In short, accredited investors have legal access to invest in financial assets that are not available to the general public. Some aspects to which accredited investors have privileged access include hedge and venture capital funds, angel investments, private equity deals, and equity crowdfunding.

Accredited investors can be high net worth individuals, banks, brokerage firms, trusts, and insurance companies. The title of accredited investor does not require any mandatory professional exam or certification. In fact, no agency grants It. Instead, it is the firms selling those unregistered securities themselves that screen their investors to verify the ones worthy of the accredited investor status. However, the screening is usually done considering specific guidelines laid down in the National Instrument 45–106 Prospectus Exemptions (“NI 45–106”). The guidelines examine factors such as location, income, net worth, asset size, and professional experience for the title to be given. Investors must, therefore, be financially sophisticated, and have reduced need for regulatory protection, among others, before they can become accredited.

The definitions of an accredited investor according to the document named above include Canadian financial banks or Schedule III banks, the Business Development Bank of Canada, persons registered under the securities legislation of a jurisdiction of Canada as advisers or dealers, pension funds, and government agencies.

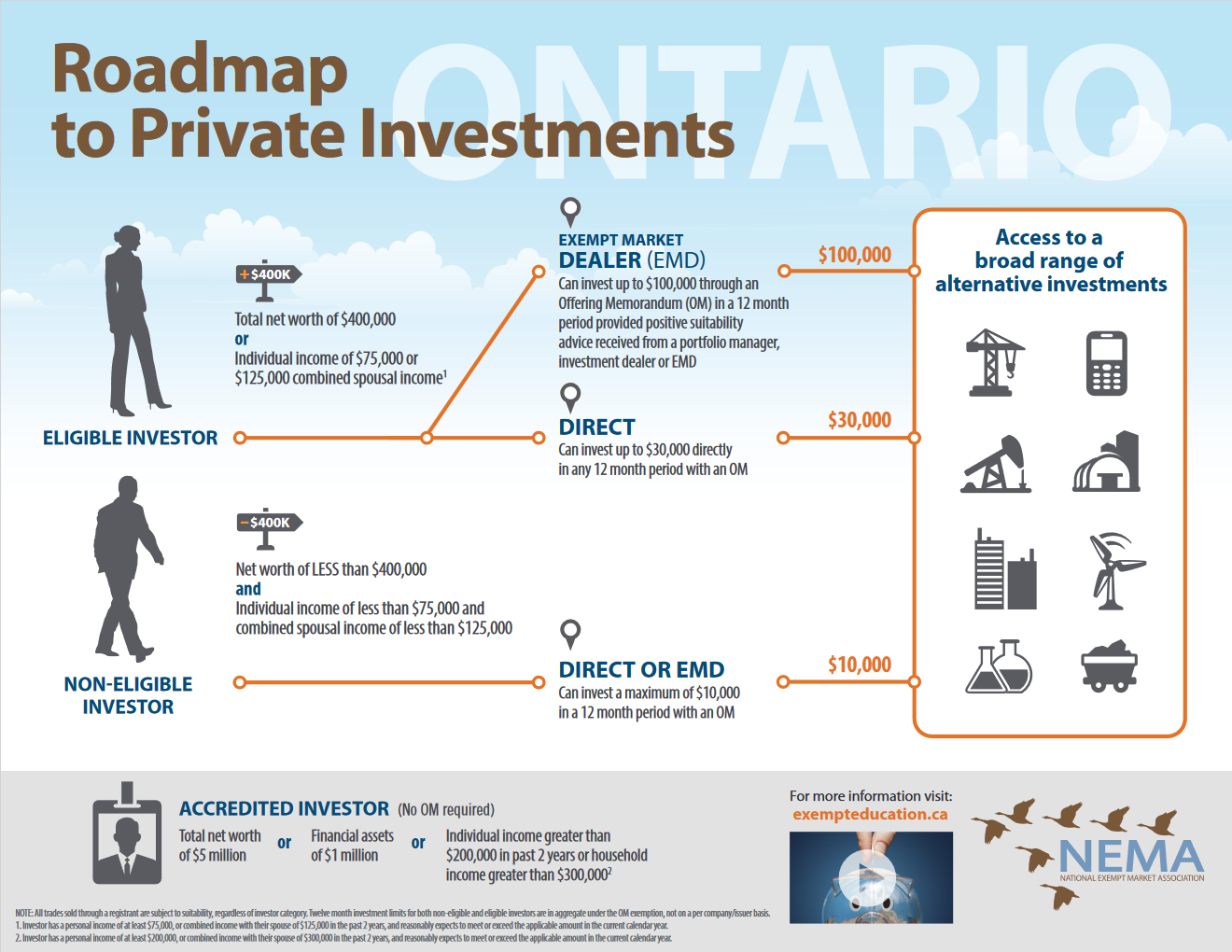

An individual who, either alone or with a spouse, has net assets of at least $5,000,000, or beneficially owns financial assets having an aggregate realizable value that before taxes, but net of any related liabilities, exceeds $1,000,000, and individuals whose net income before taxes exceeded $200,000 in each of the two most recent calendar years, or whose net income before taxes combined with that of a spouse exceeded $300,000 in each of the most recent calendar years, and who, in either case, reasonably expects to exceed that net income level in the current calendar year are also included in the definitions. Because of this reasonably high net worth required before the status of accredited investor can be granted, accredited investors have a substantially large pool of funds to invest, and can therefore afford to lose a significant portion of it without going bankrupt.

The primary benefits of being an accredited investor have to do with the fact that it gives you access to several complex investment products. You can invest in hedge funds, venture capital funds, and private equity deals, which are assets that are usually beyond the reach of ordinary investors. It opens the doors for more investment opportunities. However, for most people, becoming an accredited investor is irrelevant because even though investing in hedge funds, venture capital funds, and private equity deals may seem like an exotic thing, and the pinnacle of investing prowess, successful long term investing can also be achieved simply by buying index funds. Also, hedge funds are known to charge large investment fees, and have a high associated risk of downward capture.